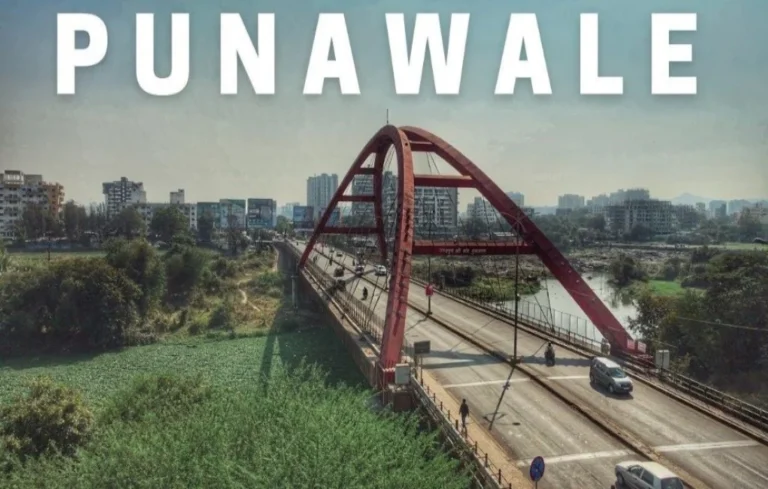

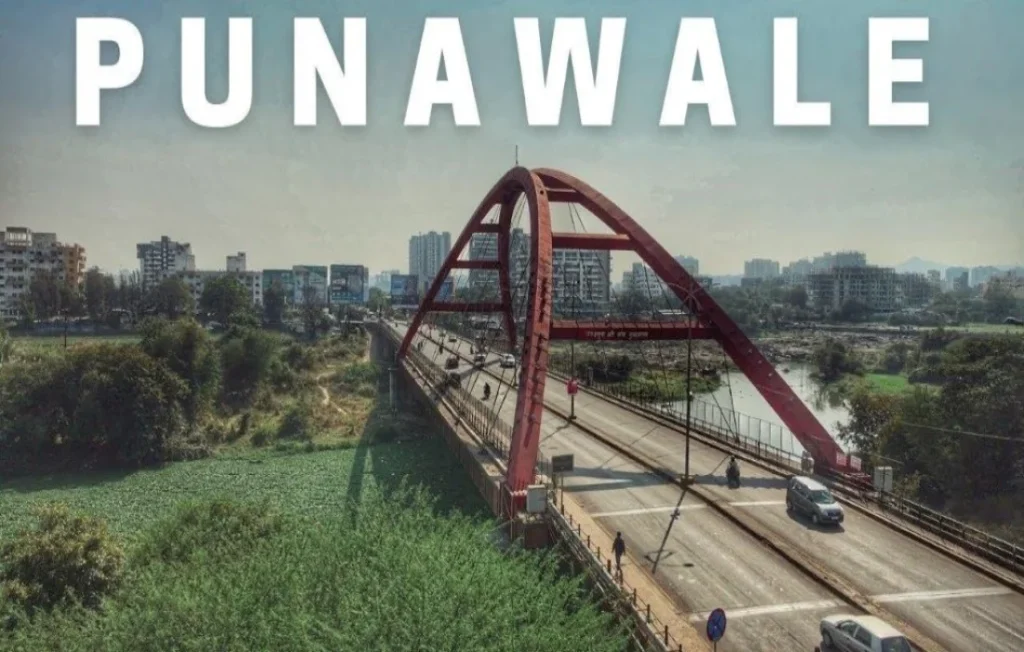

Punawale, a rapidly growing suburb of Pune, has become a prime location for real estate investment. Whether you are buying, selling, or investing in property, understanding its true value is crucial. Property valuation plays a significant role in real estate transactions, ensuring that buyers, sellers, and financial institutions make informed decisions.

What is Property Valuation?

Property valuation is the process of determining the fair market value of a property based on various factors such as location, infrastructure, demand, and future growth potential. Certified valuers or real estate experts assess a property’s worth using industry-standard methods.

Why is Property Valuation Important?

- Fair Market Pricing

Property valuation helps both buyers and sellers arrive at a fair and realistic price. Overpricing can lead to prolonged selling periods, while underpricing results in financial losses. - Loan and Mortgage Approval

Banks and financial institutions require a property valuation report before approving home loans or mortgages. It helps them determine the loan amount based on the property’s worth. - Investment Decision-Making

For investors, valuation helps in understanding potential appreciation, rental yield, and return on investment (ROI). It ensures they invest in properties with promising growth prospects. - Taxation and Legal Compliance

Property valuation is essential for calculating property tax, capital gains tax, and other statutory payments. It ensures compliance with government regulations. - Insurance and Risk Assessment

Property owners need an accurate valuation to determine the right insurance coverage. It helps in claiming compensation in case of damage, theft, or unforeseen circumstances.

How is Property Valuation Done?

- Market Approach – Comparing similar properties in the area based on recent sales data.

- Cost Approach – Estimating the cost of rebuilding the property from scratch, considering depreciation.

- Income Approach – Used for rental properties, evaluating the expected rental income over time.

Why Property Valuation is Crucial in Punawale?

Punawale is experiencing rapid development with new residential and commercial projects, enhanced infrastructure, and growing demand from IT professionals and families. A proper valuation helps buyers, investors, and sellers navigate this evolving market with confidence.

If you’re planning to buy, sell, or invest in Punawale, getting a professional property valuation is a smart step toward making informed real estate decisions.